In the pursuit of financial freedom and independence, many individuals seek alternative income streams beyond their primary sources of earnings. Residual income and passive income strategies have gained significant popularity, offering individuals the opportunity to generate income with minimal effort and time investment. While both approaches have their merits, it is essential to understand the key differences between Residual Income vs. Passive Income Strategies to make informed financial decisions. This article aims to shed light on these differences and help readers navigate the realm of alternative income generation.

Residual Income

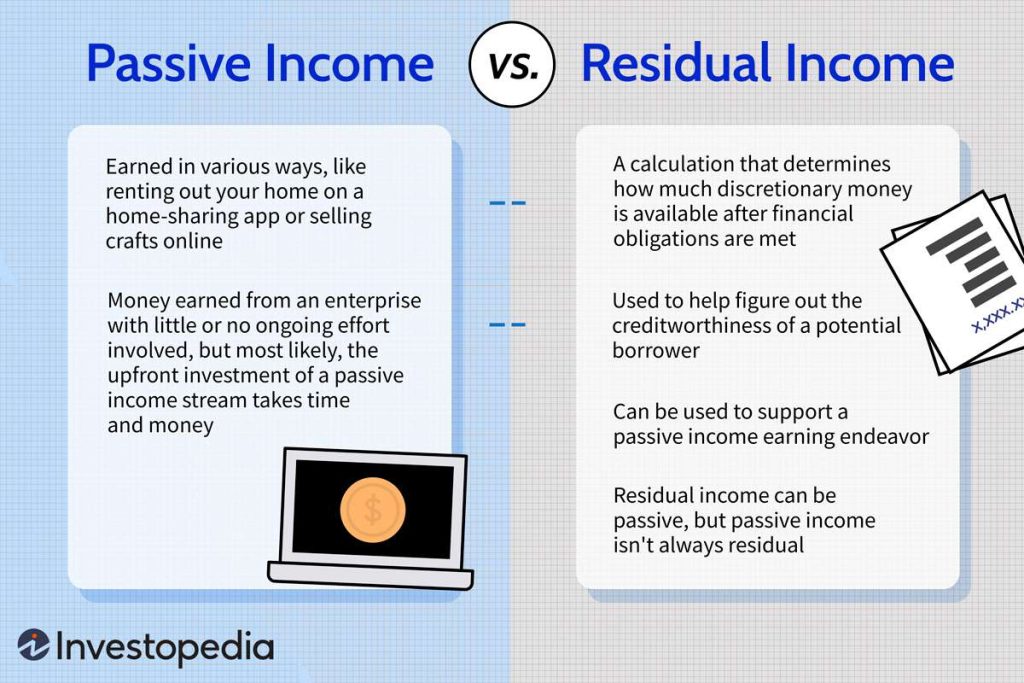

Residual income, also known as recurring income, is a type of earnings that continues to be generated after an initial effort or investment. It typically involves activities that require active participation and ongoing work to maintain a steady stream of income. Common examples of residual income include royalties from creative works, such as books, music, or films, as well as network marketing commissions, rental income, and affiliate marketing.

The distinguishing feature of residual income is that it often requires continuous engagement, even if the work has been completed in the past. Authors receive royalties as long as their books continue to sell, and landlords generate income as long as their properties are rented. This type of income can be highly lucrative, but it requires sustained effort, dedication, and the ability to create products or services with lasting value.

Passive Income

Passive income, on the other hand, refers to earnings that are generated with minimal active involvement or ongoing effort. It involves setting up systems or investments that generate income on autopilot, allowing individuals to earn money while focusing on other activities or pursuing their passions. Passive income strategies provide the potential for greater freedom and flexibility, as they require less ongoing commitment once the initial setup is complete.

Examples of passive income sources include rental income from real estate properties managed by a property management company, dividend income from investments in stocks or funds, interest from high-yield savings accounts or bonds, and income generated from online businesses with automated sales funnels.

Unlike residual income, passive income strategies are designed to be self-sustaining, requiring less active involvement over time. However, it’s important to note that setting up passive income streams often requires upfront investment, whether it be financial capital, time, or both.

Key Differences

- Active vs. Passive Engagement: Residual income requires ongoing active engagement to sustain and grow earnings, whereas passive income strategies aim to minimize active involvement once the initial setup is complete.

- Effort and Time Investment: Residual income strategies often demand continuous effort and time investment to maintain and improve income streams. In contrast, passive income strategies require significant upfront effort and time investment but offer the potential for ongoing earnings with reduced effort in the long run.

- Scalability: Passive income strategies have a greater potential for scalability, as they can be automated and expanded without significantly increasing personal involvement. Residual income streams, on the other hand, may have limitations on scalability due to the nature of ongoing active engagement.

- Income Stability: While both residual income and passive income strategies can provide stable income sources, residual income may be more susceptible to fluctuations or declines if the underlying products or services lose popularity or relevance. Passive income strategies, when properly diversified, can offer more stability and resilience.

Conclusion

Residual income and passive income strategies offer alternative routes to financial independence and freedom. Residual income requires ongoing active engagement to maintain and grow earnings, while passive income strategies aim to generate income with minimal active involvement once the initial setup is complete. Understanding the differences between these approaches is crucial for individuals seeking to diversify their income streams and achieve long-term financial goals. By evaluating personal preferences, skills, and resources, individuals can choose the most suitable strategy or a combination of both to build a sustainable and prosperous financial future.