Shopify is an e-commerce platform that provides businesses with the tools to build their online stores. The platform has grown exponentially in the past few years, and its success has been reflected in the performance of its stock. In this article, we will explore the rise and success of Shopify stock, the factors that have contributed to its growth, and its future prospects.

Overview of Shopify Stock

Shopify Inc. is a Canadian e-commerce company that was founded in 2006. The company provides a platform that enables merchants to create and manage their online stores, and it also provides various services such as payment processing, marketing, and shipping. Shopify’s stock (NYSE: SHOP) went public in 2015, and since then, it has experienced rapid growth, making it one of the most successful e-commerce companies in the world.

The stock has performed remarkably well, with its price increasing from $28.31 in 2015 to $1,209.85 in 2021. This represents a 42x increase in the value of the stock in just six years. The company’s market capitalization has also increased from $1.27 billion at the time of its IPO to over $160 billion in 2021. The company has consistently reported strong financial results, and this has contributed to the growth of the stock.

Factors Contributing to the Success of Shopify Stock

Strong Financial Performance

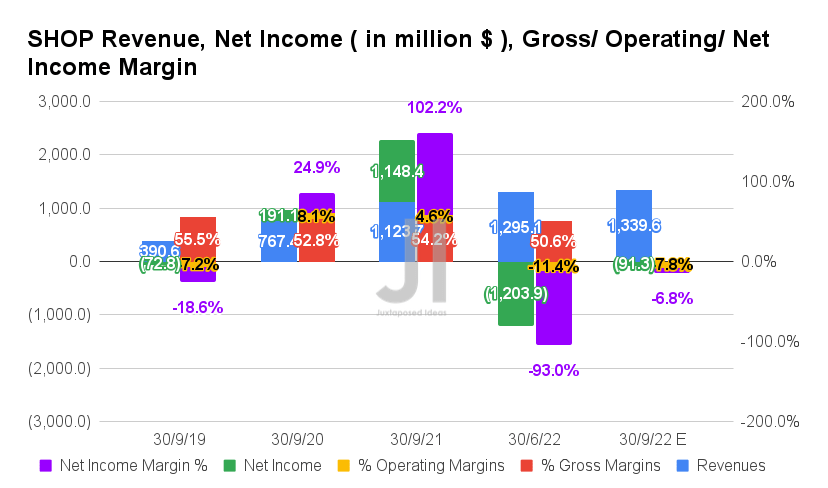

Shopify has consistently reported strong financial results, which have contributed to the growth of its stock. The company’s revenue has been growing at an impressive rate, with a CAGR of 67% between 2015 and 2020. In 2020, the company’s revenue was $2.93 billion, representing a YoY growth rate of 86%. The company’s gross merchandise volume (GMV) has also been growing at an impressive rate, with a CAGR of 75% between 2015 and 2020. In 2020, the company’s GMV was $119.6 billion, representing a YoY growth rate of 96%.

Increasing Demand for E-commerce

The COVID-19 pandemic has accelerated the shift towards e-commerce, and this has benefited companies such as Shopify. As people have been forced to stay at home, they have increasingly turned to online shopping, and this has boosted the growth of e-commerce platforms such as Shopify. According to a report by Digital Commerce 360, e-commerce sales in the US increased by 44% in 2020, and this trend is expected to continue.

Diversification of Services

Shopify has diversified its services beyond its core e-commerce platform, and this has contributed to the growth of the company and its stock. The company has launched various services such as payment processing, shipping, and marketing, and this has enabled it to capture a larger share of the e-commerce value chain. The company has also expanded its services to cater to different types of businesses, such as small and medium-sized enterprises (SMEs) and large enterprises.

Partnerships and Acquisitions

Shopify has entered into various partnerships and made strategic acquisitions, which have contributed to the growth of the company and its stock. For instance, the company has partnered with Facebook, Google, and Walmart to expand its reach and services. The company has also made strategic acquisitions such as the acquisition of 6 River Systems, a fulfillment robotics company, which has enabled it to provide better fulfillment services to its customers.

Future Prospects of Shopify Stock

Shopify’s future prospects look bright, given the growing demand for e-commerce and the company’s strong financial performance. The company is well-positioned to capture a larger share of the e-commerce market, given its expanding services and partnerships