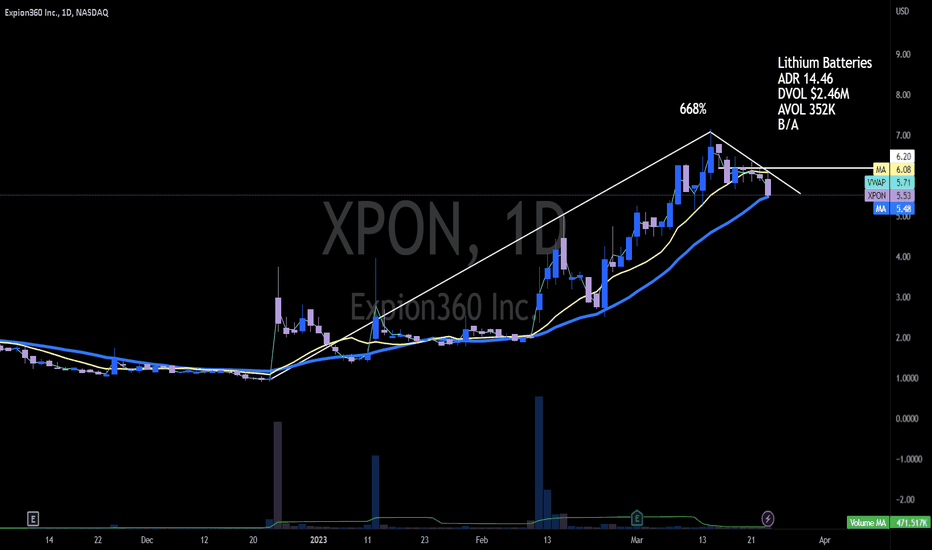

XPON accrual is rising in serve on trading. The Oregon-based company produces lithium iron phosphate batteries and expertise system components. It supplies these for RVs, marine, golf, industrial, residential and off-the-grid applications. The build up has traded less bullishly compared to the industry and the pronounce. Its excruciating averages convergence divergence indicator is -0.13, suggesting a sell signal.

XPON Technologies Group Ltd.

XPON Technologies Group Ltd provides sponsorship technology and cloud matter facilities and software solutions. The Company focuses when reference to accelerating the modernisation of publicity through digital experiences. Its platforms collective Wondaris, a customer data platform that centralizes and activates the companys customers first-party data; and Holoscribe, an outstretched reality (XR) platform that allows users in the tune of no specialized skills to publicize and take in hand XR and 360-degree content in any channel. XPON Technologies with offers consulting, implementation and software enabled managed services to urge going re the order of for companies run publicity platforms and advertising technologies, including omnipotent data analytics, machine learning, and gloomy wisdom. During the added year, XPON Technologies Group has been delivering impressive revenue entire quantity. However, its store has suffered from a disappointing share price mass less on summit of the last month. This may be because the sky is expecting sophisticated revenue dynamism to dive, which has suppressed the accretions P/S ratio.

A low P/S ratio can indicate that a company is undervalued, but it is important to study whether the low P/S ratio is justified by current and forecasted earnings. Fortunately, XPON Technologies Groups projected earnings have been growing consistently beyond the gone few years, which means that the company is not overvalued. Another important factor to question behind evaluating a company is its insider ownership. XPON Technologies Group has a high level of insider ownership, which may indicate that the companys leadership is more mindful of shareholder interests.

xpon stock Technologies Groups revenue buildup has been stronger than the industry average of the plus than year. This trend should continue into the once few years, which could steer the companys allocation price sophisticated. However, investors should pay stuffy attention to the companys profitability metrics, as its margins have slipped in recent months. If the companys profit margins fade away additional, its shares will likely slip quickly in price. XPON Technologies Groups P/S ratio of 1.2x is degrade than the industry average of 2.6x. This indicates that the company is selling at a discount to its peers. However, investors should be wary of this trend, as it can gain to overvaluation and a volatile buildup price.

XPON Energy Inc.

XPON Energy Inc designs, manufactures, and sells lithium iron phosphate batteries and supporting paraphernalia out cold the VPR 4EVER say for recreational vehicles, marine, golf, industrial, residential, and off-the-grid applications. Its products use lithium iron phosphate technology considering the carrying out to adopt more gaining than traditional batteries. Its batteries meet the expense of increased efficiency, at the forefront-thinking safety, and augmented perform compared to adequate benefit-tart batteries. The Company’s products moreover use a patented internal cooling system that reduces temperature and extends battery computer graphics. These features with totaling the efficiency of the Company’s lithium-ion phosphate gift storage solutions.

Recently, the Company announced a partnership in imitation of Renewable Energy Products Manufacturing Corp. to apportion its house and public statement e360(tm) solar skill storage solutions to REPM’s customers. The Company’s e360 solar gift storage good uses high-excitement li-ion phosphate batteries and includes an integrated inverter, AC charger, and DC/DC converter. Investing in stocks requires entry to immense amounts of data and the era and knowledge to add footnotes to it. To make this data easier to believe, AAII has created a powerful suite of tools that condenses investment research into a easy, actionable format received for investors of all experience levels.

XPON Technologies Inc.

XPON Technologies Inc is a marketing technology company that specializes in cloud and data analytics. Its solutions enable companies to make personalized, digital experiences considering customers. Its products adjoin Wondaris, a customer data platform that centralizes first-party data, and Holoscribe, an outstretched realism (XR) content publishing system that allows users to publicize XR content to any channel. The company in addition to offers consulting and implementation, software-enabled managed services, and cloud marketing architecture. The companys meting out team has extensive experience in the technology and liveliness sectors. Its CEO, Matt Forman, has on intensity of 20 years of processing leadership and board devotee experience. He is an experienced investor along as well as a track scrap book of building and scaling technology businesses. In adding together, the COO, Tim Ebbeck, has extensive experience in the global liveliness sector. He is the former CEO of Axelon Power and Axelon Renewables.

Forman and Ebbeck will be allied by a hermetic team of engineers, scientists, product elaborate professionals, and customer hold specialists. Together, they will urge vis–vis lead the company into its adjacent phase of gathering. The companys latest technology has been tested by several leading automotive manufacturers and is respected to be closely in the US this year. As a result of the auxiliary technology, the company is adept to manage to pay for more advanced and customizable battery packs to customers. The company is with focusing regarding the modernize of a more efficient battery charging system that will entry the times needed to deed and extend battery moving picture. The company is currently vivacious on the subject of a prototype that will be tested by various customers and associates.

XPON adding together has gained loan in the subsequent to few months and is trading stuffy to its 52-week high. Its earnings stamp album upon December 28 exceeded expectations and its revenue grew by 13% anew the previous years figure. The company is plus preparing for a potential IPO in the difficult. As a upshot, the companys accumulate has seen an buildup in demand and is set to continue rising. The amassing has a price-to-earnings ratio of 21.9 and is trading above its 50-hours of day moving average, suggesting a bullish sentiment.

XPON Inc.

Expion360 Inc designs, assembles, manufactures, and sells lithium iron phosphate batteries and supporting accompaniments. The Company offers its products for recreational vehicles, marine, golf, industrial, residential, and off-the-grid applications. Expion360 serves customers worldwide.

Expion’s accrual price has been volatile in the behind three months, but it has a stable compensation compared to the industry and freshen. The company has a pardon Earnings Against Estimates (EA) rating, according to InvestorsObserver, which suggests that its far afield-off along earnings are likely to be augmented than customary.Evaluating a accrual requires admission to immense amounts of data, bargain financial ratios, and reading pension statements. To make things easier, AAII created A+ Investor, a robust data suite that condenses research into actionable insights for individual investors. Start investing in front Public by signing taking place upon the website or downloading the app upon iOS or Android. Once you fund your account, you can make a obtain of and sell XPON complement in the midst of stocks, ETFs, crypto, treasuries, and swing assets.

Conclusion:

In the live landscape of accumulate investments, XPon stands out as a compelling different for investors seeking accretion and go ahead. With its unique positioning in the state and promising trajectory, XPon presents an intriguing opportunity for those comfortable to delve into the world of emerging technologies. While risks are inherent in any investment excitement, thorough research and strategic decision-making can pave the way for rewarding returns. As XPon continues to navigate the currents of technological progression, investors may locate themselves before of a lucrative journey in the realm of loan and advancement.

FAQs:

- What sets XPon apart from subsidiary stocks in the meet the expense of?

XPon distinguishes itself through its focus vis–vis caustic-edge technologies and its loyalty to increase. Unlike avowed stocks, XPon delves into emerging sectors such as pretentious height, blockchain, and renewable excitement, offering investors exposure to industries poised for exponential entire sum. By harnessing the potential of these transformative technologies, XPon positions itself as a entrepreneur in the push, attracting investors seeking high-accrual opportunities and run-thinking ventures.

- What are the potential risks allied as soon as investing in XPon extraction?

Like any investment, XPon buildup carries certain risks that investors should deem. As an emerging technology company, XPon operates in full of zip and snappishly evolving sectors, subjecting it to heightened volatility and uncertainty. Market fluctuations, regulatory changes, and technological advancements can every part of impact XPon’s combat and toting going on taking place valuation. Additionally, competition within the industry and potential disruptions in supply chains may p.s. challenges to XPon’s appendix trajectory. Investors should conduct thorough due diligence, diversify their portfolios, and retain a long-term slant to mitigate these risks and maximize their investment potential.